Using M-PESA in Kenya as a Tourist: A Complete Guide

If you're travelling to Kenya, one of the most convenient tools you'll need is M-Pesa. It's a mobile money service that’s widely used across the country, and as a tourist, it can make your experience smoother, safer, and far more enjoyable.

What is M-Pesa?

M-Pesa is a mobile money platform run by Safaricom, Kenya’s largest telecom company. It allows you to send, receive, and store money on your phone and pay for goods and services without needing a bank account (Only 8% of Kenyans have a bank account!).

Whether paying for a meal at a restaurant or buying souvenirs from a street vendor, M-Pesa is accepted almost everywhere.

What Kenya can teach it’s neighbours and the US (M-Pesa) - Vox

Why Use M-Pesa?

It’s Safer than Carrying Cash

Kenya is largely cash-based, but M-Pesa eliminates the need to carry large amounts of money, reducing the risk of theft or loss. Your money is stored safely on your phone, protected by a PIN.Accepted Everywhere

M-Pesa is widely accepted across Kenya, from big businesses to tiny market stalls. As long as someone has a phone number, they can receive M-Pesa payments. It's great for paying taxi drivers, buying groceries, and even tipping.Easy to Withdraw Cash

If you ever need cash, you can withdraw money from any M-Pesa agent. These agents are everywhere—from supermarkets to small kiosks in villages.Many vendors may give you discounts for buying things in cash (M-Pesa is basically the same as cash) instead of credit cards so using M-Pesa gives you more bargaining power.

Power outages can mean shops can not accepts cards so M-Pesa would be a safe alternative

M-Pesa numbers are usually displayed at the counter of most places - Simba Dishes in Malindi

How to Get Set Up as a Tourist

Buy a Safaricom SIM Card

The first step to using M-Pesa is to get a local SIM card. Safaricom is your best bet, and you can easily get a SIM card at the airport or a Safaricom store. The SIM itself costs around 100 KSH (less than £1). Remember to bring your passport, as you'll need it to register your SIM.Choose a Data Pack

You'll need data to use M-Pesa efficiently. A typical data package costs around 400Ksh (£20) for 20GB, and this includes some minutes and texts, which should last most tourists for their entire trip.Set Up M-Pesa

Once you have your SIM, head to a Safaricom store and ask the staff to help you set up M-Pesa. They’ll do everything for you, including linking it to your phone number. Just bring some cash and your passport so they can load it into your M-Pesa account.

I have an iPhone 13 Pro, which (like most modern phones) allows you to use a physical SIM card and multiple E-sims simultaneously. My regular UK line is an E-sim, meaning whenever we travel, I can easily get a local physical sim and use it alongside my home line. We did this when visiting Marrakech as well.

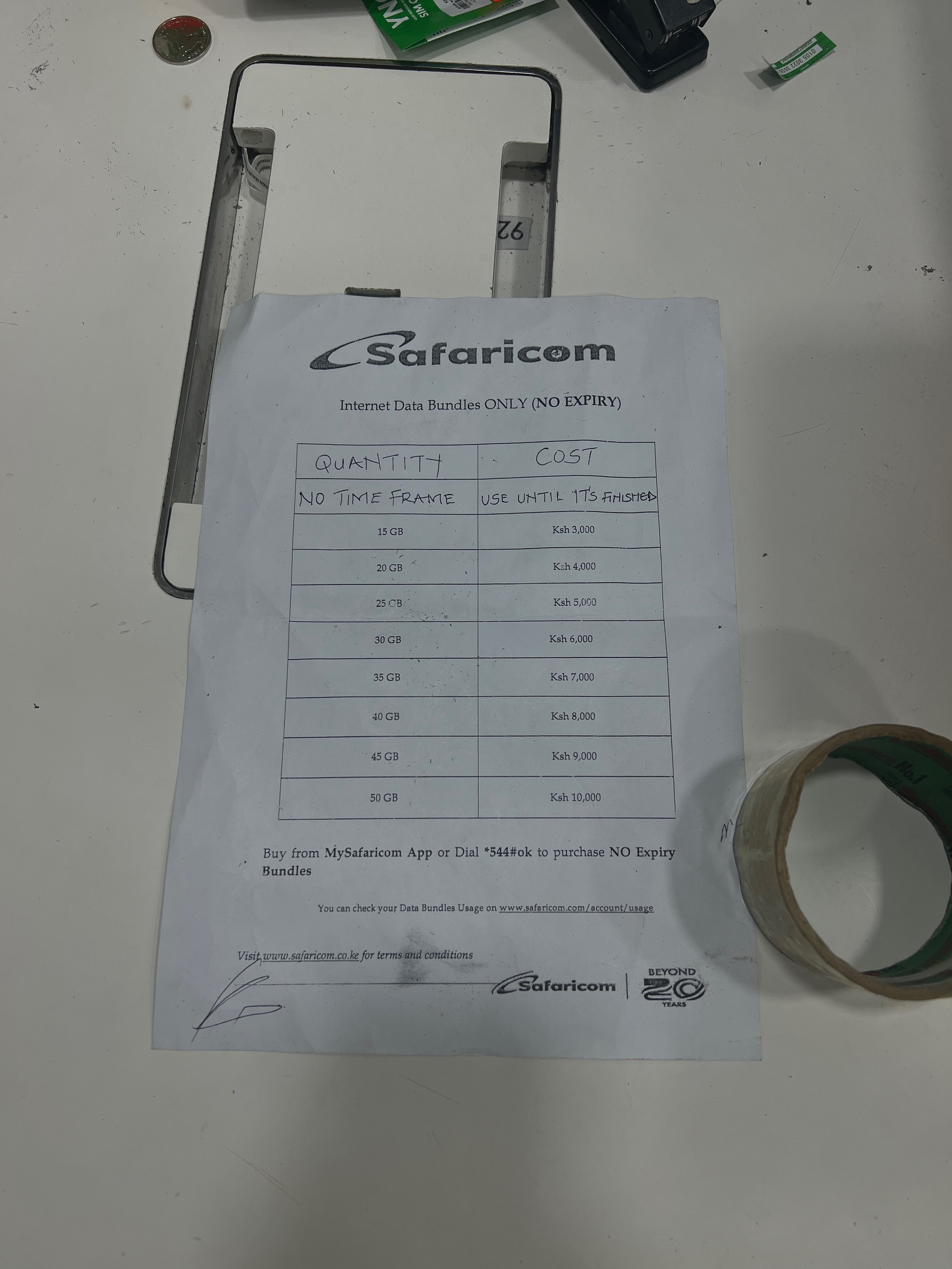

Safaricom data packages

Topping Up Your M-Pesa

There are two main ways to top up your M-Pesa balance as a tourist:

Topping Up with Cash

You can walk into any Safaricom outlet, supermarket, or even a small street kiosk and top up your M-Pesa with cash. Agents are everywhere, making this the easiest way to get money into your account. Just be aware that these stalls need to have enough money in their own M-Pesa accounts to send you so smaller stalls may not be able to make large deposits for you.Using the Nala App

A more convenient way, especially if you’re using a foreign bank account, is to use the Nala app. This app allows you to top up your M-Pesa account instantly using Apple Pay, credit cards, or other international payment methods. Nala offers excellent exchange rates, usually close to the credit card rates, and charges minimal fees.

M-Pesa Charges

While M-Pesa is largely free for receiving money and checking your balance, there are some minimal charges for sending and withdrawing money. Here's a basic breakdown:

Sending up to 100 KSH: 0.5 KSH

Sending 100–500 KSH: 6 KSH

Sending 500–1,000 KSH: 12 KSH

Sending 1,000–5,000 KSH: 35 KSH

35KSH = approx 0.20GBP

There are also daily transaction limits. Currently, you can hold up to 300,000 KSH (£1,500) in your M-Pesa account at one time and send a maximum of 150,000 KSH (£750) per transaction.

Nala Charges

If you're using Nala to top up your M-Pesa balance, expect the following charges:

Transfer Fees: Typically around £2 per transfer, but this varies based on the amount.

Exchange Rate: Nala’s exchange rate is usually very competitive, closely matching the rates offered by major credit cards.

Paying with M-Pesa

Once you have money in your M-Pesa account, here’s how you can pay for goods and services:

Using the M-Pesa App

The app works even if you run out of data, ensuring you’re never stranded. Open it and follow the steps to make payments.Sending to a Phone Number

Enter the recipient’s phone number, input the amount, and confirm the transaction. You’ll get an SMS confirmation instantly. When you enter the number, you will be shown the receiver’s name so you can confirm you have the correct person.Buy Goods Option

Many vendors and shops will prompt you to use the "Buy Goods" option in the app, which allows for a quick and easy payment directly from your phone. The store will have a ‘till number’ which you put in alongside how much you want to pay.Prompt Payments

Some places will ask for your phone number and send you a prompt to pay, which is even quicker.

If you are ever unsure of how to make a payment using M-Pesa, ask the store owner, who will tell you the best way to do it.

Paying for the Karen Blixen Museum with M-Pesa

Paying for some chapatti and beans with M-Pesa

How to Reverse an M-Pesa Payment

If you make a mistake like sending the money to the wrong number (we did this once when paying for a takeaway delivery in Malindi), you can reverse a payment almost instantly through the M-Pesa app.

If this doesn’t work, you can forward the transaction confirmation SMS to 456 so Safaricom can handle the reversal.

Network Issues and Using M-Pesa Offline

In some remote areas, mobile data might be weak or unavailable. But don’t worry, you can still make payments using M-Pesa’s offline USSD service by dialling *334#, allowing you to access your account and make payments without the app.

You'll see M-Pesa everywhere in Kenya

Be Aware of Scams

M-Pesa is incredibly secure, but it’s important never to share your M-Pesa PIN with anyone. Also, always double-check the details before sending money to avoid falling victim to common scams.

Whenever you enter the recipient's number into your app, it will show you their account name so you can confirm you have the correct details before clicking send.

Using M-Pesa for Tipping

Tipping with M-Pesa is very common in Kenya. Whether it’s a guide, driver, or hotel staff, many service workers prefer receiving tips through M-Pesa rather than cash, making it an easy and polite way to show your appreciation.

M-Pesa till number at Simba Dishes, Malindi

M-Pesa till number at the counter - Sea Front in Malindi

Roaming with Safaricom

If you’re planning to visit other countries in Africa, note that M-Pesa only works within Kenya. However, Safaricom’s SIM card can work in other countries with roaming charges applied. It’s important to check the rates before you leave Kenya

Using M-Pesa as a tourist in Kenya will enhance your travel experience. It’s safe, fast, and accepted everywhere, making it an essential tool. Follow this guide to get set up, and you’ll enjoy your trip without worrying about handling cash or finding an ATM.